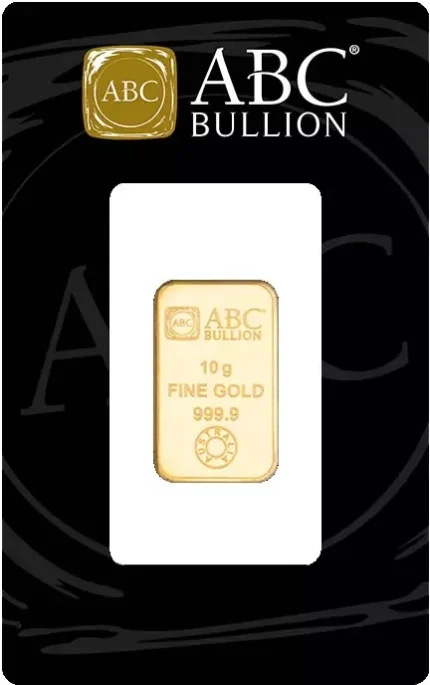

The ABC Bullion 100g gold cast bar is serialised and comes with an assay certificate, guaranteeing metal weight, purity and origin. Weight: 3.215 ounces.

Description

Reviews (0)

Be the first to review “ABC Bullion Cast Gold Bar 100g” Cancel reply

Shipping & Delivery

MAECENAS IACULIS

Vestibulum curae torquent diam diam commodo parturient penatibus nunc dui adipiscing convallis bulum parturient suspendisse parturient a.Parturient in parturient scelerisque nibh lectus quam a natoque adipiscing a vestibulum hendrerit et pharetra fames nunc natoque dui.

ADIPISCING CONVALLIS BULUM

- Vestibulum penatibus nunc dui adipiscing convallis bulum parturient suspendisse.

- Abitur parturient praesent lectus quam a natoque adipiscing a vestibulum hendre.

- Diam parturient dictumst parturient scelerisque nibh lectus.

Scelerisque adipiscing bibendum sem vestibulum et in a a a purus lectus faucibus lobortis tincidunt purus lectus nisl class eros.Condimentum a et ullamcorper dictumst mus et tristique elementum nam inceptos hac parturient scelerisque vestibulum amet elit ut volutpat.

Related products

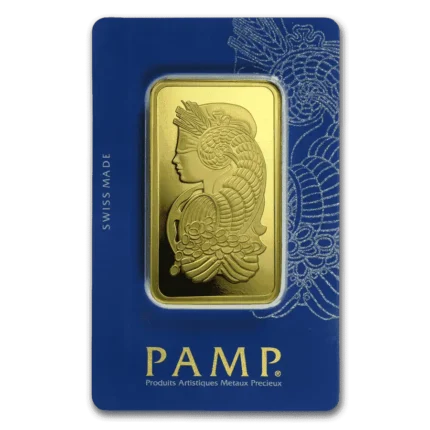

1 oz PAMP Suisse Lady Fortuna Minted Gold Bar

$4,217.77

1 oz PAMP Suisse Lady Fortuna Minted Gold Bar (Pre-order)

The 1 oz PAMP Suisse Lady Fortuna Minted Gold Bar is one of the most renowned and respected gold bars in the world, recognized for its quality, craftsmanship, and beautiful design. Here are key features of this bar: Buy 1 oz PAMP Suisse Lady Fortuna Minted Gold Bar OnlineABC Bullion Gold Minted 10 gram Bar

$1,376.20

ABC Bullion Gold Minted 5 gram Bar

$72,910.00

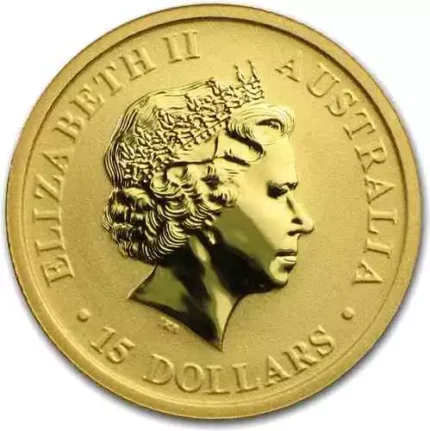

Perth Mint 2023 Koala 1/10 oz Gold Coin

$492.58

Perth Mint 2023 Koala 1/10 oz Gold Coin

$496.28

Perth Mint 2024 Lunar Dragon 1/4 oz Gold Coin

$1,105.69

Perth Mint Gold Kangaroo Nugget 1/10 oz 2016 BU

$467.47

Pool Allocated Gram Gold

$130.54

Purity: 99.99%

Purity: 99.99%

You may be interested in Pool Allocated products if you are seeking:

If you wish to take possession of your Gold, there will be a barring fee applied. Please ask the GBA team for details. Rather than buying a specific item, you can invest in the pool of products with 100% backing by physical metal which is fully insured for replacement value. If you buy a ‘share’ in the pool of gold, silver or platinum it is managed and stored by Gold Bullion Australia Treasury Reserve (GBATR) on your behalf in our secure, custom built vaulting facility.

There are many factors that affect the price of Gold. The most important factors include the overall global demand for Gold, interest rates on financial products and services, the value of the United States Dollar (measured via the U.S. index which highlights the value of the U.S. dollar relative to a basket of foreign currencies), the amount of Gold procured by or held within Central Bank reserves, as well as worldwide appetite for holding Gold as a hedge against both rising inflation and currency devaluation. All of the above factors combine to drive the price of Gold. Ultimately, as the flow of cash into the Gold market increases, the supply of Gold decreases, causing the price of Gold to rise.

-

Secure Storage at no cost.

-

No shipment costs or risks.

-

High liquidity, the fastest way to buy and sell.

-

Regular reporting showing the current value of holdings and transaction history.

-

A suitable option for SMSF with regular auditing, reporting, insurance and compliant, offsite storage.

-

100% backed by physical metal.

-

Fully insured for replacement value (by Lloyds of London).

If you wish to take possession of your Gold, there will be a barring fee applied. Please ask the GBA team for details. Rather than buying a specific item, you can invest in the pool of products with 100% backing by physical metal which is fully insured for replacement value. If you buy a ‘share’ in the pool of gold, silver or platinum it is managed and stored by Gold Bullion Australia Treasury Reserve (GBATR) on your behalf in our secure, custom built vaulting facility.

There are many factors that affect the price of Gold. The most important factors include the overall global demand for Gold, interest rates on financial products and services, the value of the United States Dollar (measured via the U.S. index which highlights the value of the U.S. dollar relative to a basket of foreign currencies), the amount of Gold procured by or held within Central Bank reserves, as well as worldwide appetite for holding Gold as a hedge against both rising inflation and currency devaluation. All of the above factors combine to drive the price of Gold. Ultimately, as the flow of cash into the Gold market increases, the supply of Gold decreases, causing the price of Gold to rise.

Reviews

There are no reviews yet.