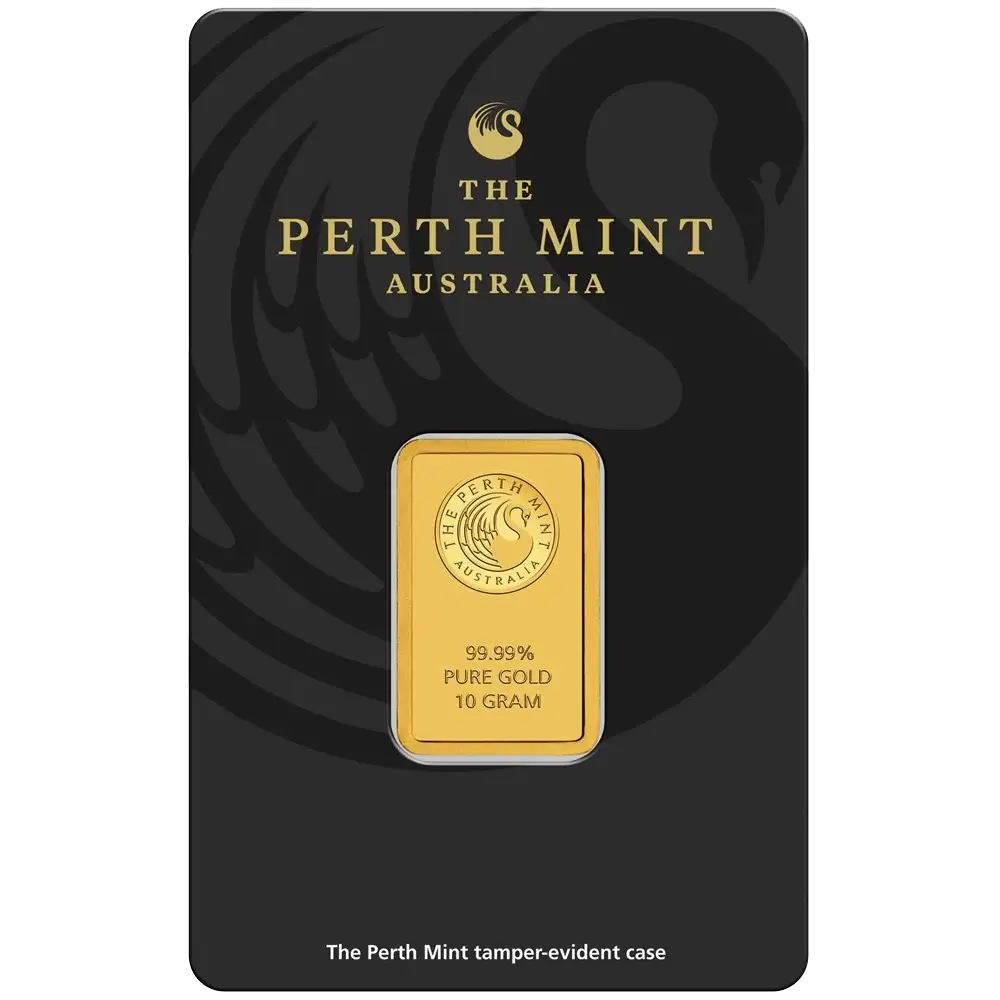

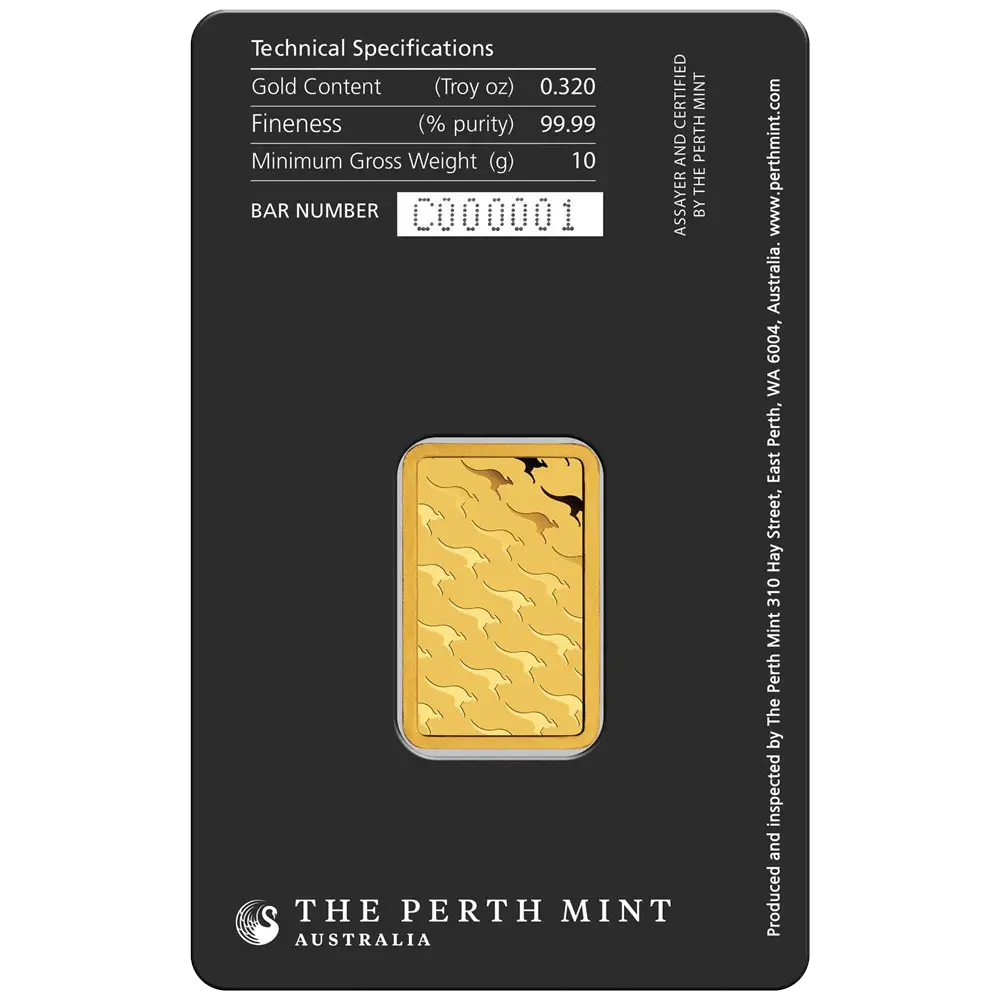

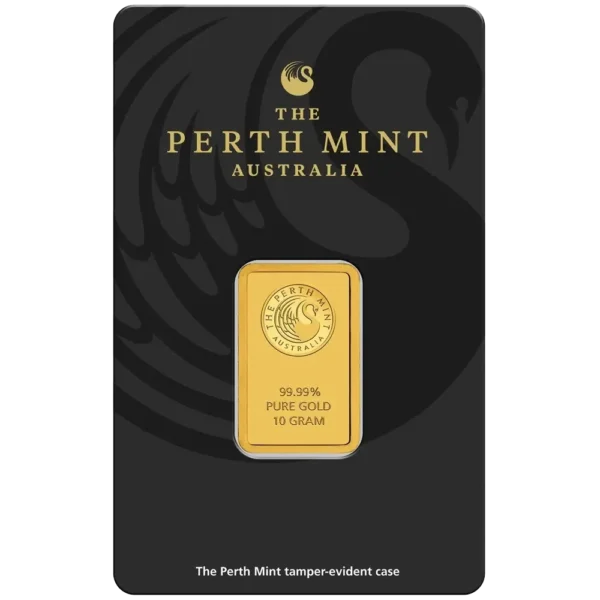

This 10g gold bullion minted bar is one of eight sizes available from The Perth Mint.

Perth Mint Gold 10 Gram Kangaroo Minted Bar

$1,375.20

15

People watching this product now!

Fast Shipping

Carrier information

20k products

Payment methods

24/7 Support

Unlimited help desk

2-day Delivery

Track or off orders

Reviews (0)

Rated 0 out of 5

0 reviews

Rated 5 out of 5

0

Rated 4 out of 5

0

Rated 3 out of 5

0

Rated 2 out of 5

0

Rated 1 out of 5

0

Be the first to review “Perth Mint Gold 10 Gram Kangaroo Minted Bar” Cancel reply

Reviews

Clear filtersThere are no reviews yet.